how much federal tax is taken out of my paycheck in illinois

For 2022 employees will pay 62 in Social Security on the first 147000 of wages. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

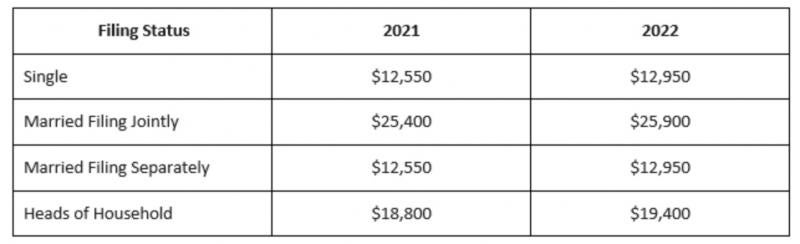

What Are Marriage Penalties And Bonuses Tax Policy Center

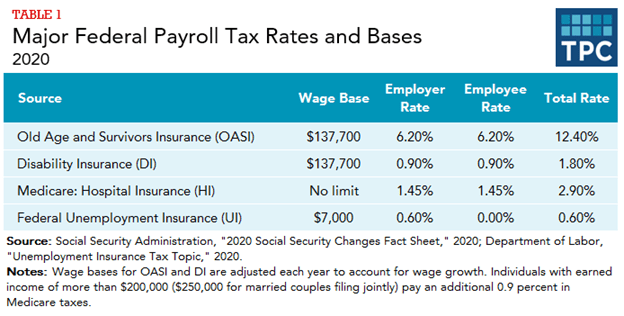

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS.

. If you increase your contributions your paychecks will get smaller. Employers in Illinois must deduct 145 percent from each employees paycheck. Check out our new page tax change to find out how federal or state tax changes affect your take home pay.

In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay. According to some changes in the W-4 Employee Withholding Certificate find out more about that here earnings that are too low might not have their income taxes withheld at all. If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with 6000 372 87 5541.

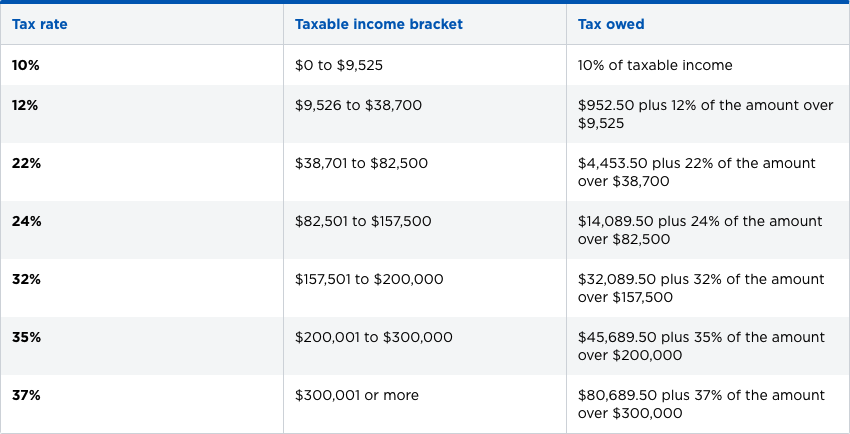

10 12 22 24 32 35 and 37. Employers must match this tax. Employees who file for exemption from federal income tax must still have Medicare taxes.

Both employers and employees are responsible for payroll taxes. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income Tax Rates and Thresholds in 2022. With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396 percent.

Switch to Illinois hourly calculator. Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy. However they dont include all taxes related to payroll.

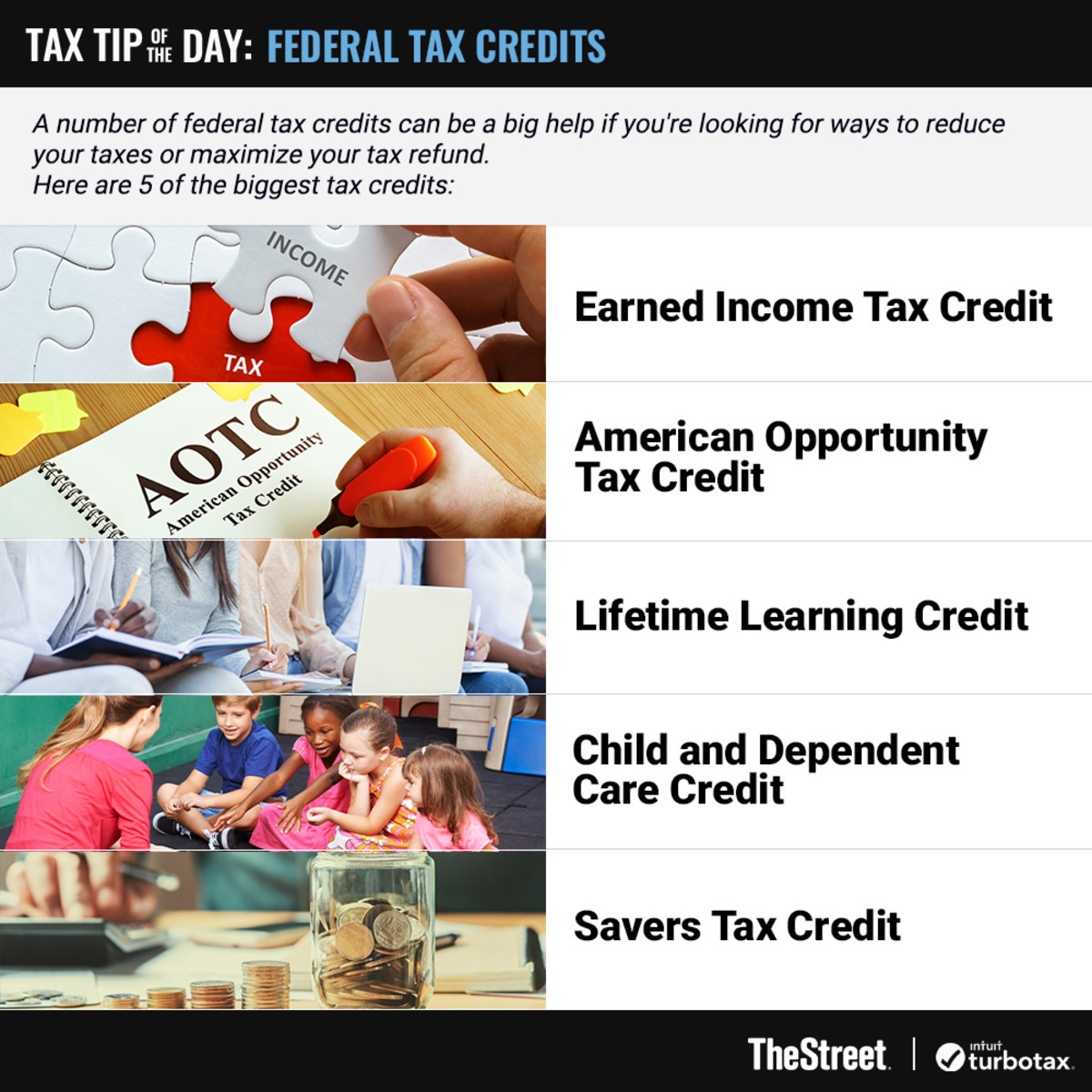

How do I calculate how much tax is taken out of my paycheck. This marginal tax rate means that your immediate additional income will be taxed at this rate. It can also be used to help fill steps 3 and 4 of a W-4 form.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. For instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by 6387. Details of the personal income tax rates used in the 2022 Illinois State Calculator are published below the.

However making pre-tax contributions will also decrease the. Employers also must match this tax. For the employee above with 1500 in weekly pay the calculation is 1500 x.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. In 2021 the federal income tax rate tops out at 37. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Your average tax rate is 229 and your marginal tax rate is 346. These amounts are paid by both employees and employers. FICA taxes are commonly called the payroll tax.

Your bracket depends on your taxable income. Federal income tax and fica tax withholding are mandatory so. Your average tax rate is 222 and your marginal tax rate is 361.

This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

This calculator is intended for use by US. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. Unlike Social Security all earnings are subject to Medicare taxes.

Use tab to go to the next focusable element. FICA taxes consist of Social Security and Medicare taxes. What is federal income tax.

However each state specifies its own tax rates which we will. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. Personal income tax in Illinois is a flat 495 for 20221.

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. For Medicare tax withhold 145 of each employees taxable wages.

If no federal income tax was withheld from your paycheck the reason might be quite simple. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. Illinois Hourly Paycheck Calculator. You didnt earn enough money for any tax to be withheld.

For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in a given calendar year. There are seven federal tax brackets for the 2021 tax year. Our online Weekly tax calculator will automatically.

Youll use your employees IL-W-4 to calculate how much to withhold from their paycheck. It depends as the IRS uses one of two methods.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

My Tax Return Is So Low This Year When It S Been Generally Bigger Other Years And I Can T Figure Out Why I Worked Full Time All Year I Ve Looked Over My 1040

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

Irs Tax Refund Status Illinois Residents Still Waiting For Federal Tax Refunds 9 Months After Filing Abc7 Chicago

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

How Much Is 620 000 A Year After Taxes Filing Single Smart Personal Finance

How To Read And Respond To Your Notice From The Irs Irs Reading Internal Revenue Service

Federal Income Tax Brackets Brilliant Tax

Tax Day Is April 18 This Year Here S Why Thestreet

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Paycheck Calculator Take Home Pay Calculator

How Do State And Local Individual Income Taxes Work Tax Policy Center

2022 Tax Inflation Adjustments Released By Irs

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

What Is Local Income Tax Types States With Local Income Tax More

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)